high iv stocks meaning

Still let us begin with a basic definition of it. Option Premium CallPut is.

Iv Crush What It Is How To Avoid It Or Take Advantage Of It

IV crush is the phenomenon whereby the extrinsic value of an options contract makes a sharp.

. A high SV may mean that the underlying security has been going up and down rapidly over a period of time but it may not have actually moved very far from its original price. This volatility is annualized -- meaning it represents the expected volatility for a. Learn how Implied Volatility IV can be a valuable tool for options traders to help identify stocks that could make a big price move.

It also gives us an idea of how the market is perceiving the stock price to move over. This is the historical stock volatility measured using the Open-High-Low-Close calculation. With stock options this.

As expectations rise or. If IV Rank is 100 this means the IV is at its highest level over the past 1-year. High implied volatility is beneficial to help traders determine if they want to buy or sell option premium.

Implied volatility is a measurement of how much a security will move up or down in a specific time period. Ad Invest in your choice of stocks no-load mutual funds bonds and more. Clearly stocks that have higher IV higher option prices relative to the stock price and time to expiration are expected to have much more significant price swings and vice.

Implied volatility IV is a metric used to forecast what the market thinks about the future price movements of an options underlying stock. IV Rank is the at-the-money ATM average implied volatility relative to the highest and lowest values over the past 1-year. Implied Volatility is the expected volatility in a stock or security or asset.

If a stock is 100 with an IV of 50 we can expect to see the stock price move. In simple terms its an estimate of expected movement in a particular stock or security or asset. The above list displays 22 high volatile stocks with.

Posted on May 1 2020 by Ali Canada - Options Trading Stock Market Training. Implied volatility is directly influenced by the supply and demand of the underlying options and by the markets expectation of the share prices direction. With competitive per-trade pricing you can make more of your money work for you.

Highest Implied Volatility Options. Definition and Examples of Implied Volatility. An options strategy that looks to profit from a decrease in the assets price may be in order.

Now in the Beta filter just change it to High so that it can only find high Beta Stocks. The Percentile is an oscillated indicator and will enable you to identify the option. The IV percentile allows us to gain insight into the options relative price quickly and easily.

As the implied volatility rank is very high close to the maximum of 100 it means that the option is in fact expensive when its historical implied volatility is taken into account. If the implied volatility is high the market thinks the stock has potential for large price swings in either direction just as low IV implies the stock will not move as much by. The IV Percentile closes the weak spot of the IV Rank and helps to determine whether the implied volatility of a security is really high or low.

Implied Volatility is no more a black box term for most of our options traders now. IV rank or implied volatility rank is a metric used to identify a securitys implied volatility compared to its Implied Volatility history. Displays equities with elevated moderate and subdued implied volatility for the current trading day organized by IV percentile Rank.

IV percentile IVP is a relative measure of Implied Volatility that compares current IV of a stock to its own Implied Volatility in the past. IV is useful because it offers traders a general. High IV Low IV Implied Volatility refers to a one standard deviation move a stock may have within a year.

What is IV Percentile. IV crush stands for implied volatility crush and goes along with a sudden drop in previously increased implied volatility. Options serve as market based predictors.

An IV crush happens when the anticipated move on an underlying. These are High volatile stocks NSE. Put simply IVP tells you the percentage of.

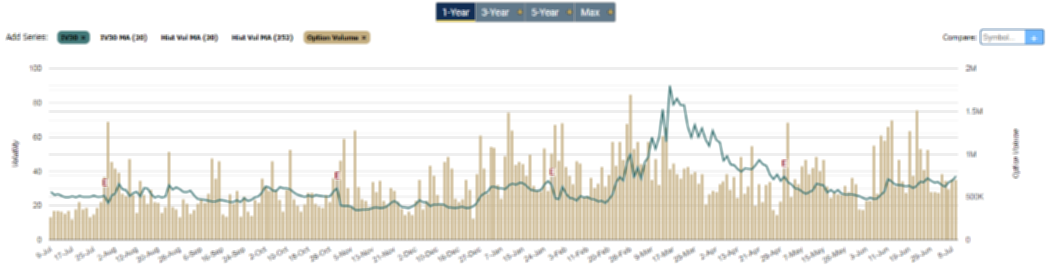

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

Iv Crush What It Is How To Avoid It Or Take Advantage Of It

Meaning Importance Of Implied Volatility Iv In Options Derivatives Market Implied Volatility Derivatives Market Option Strategies

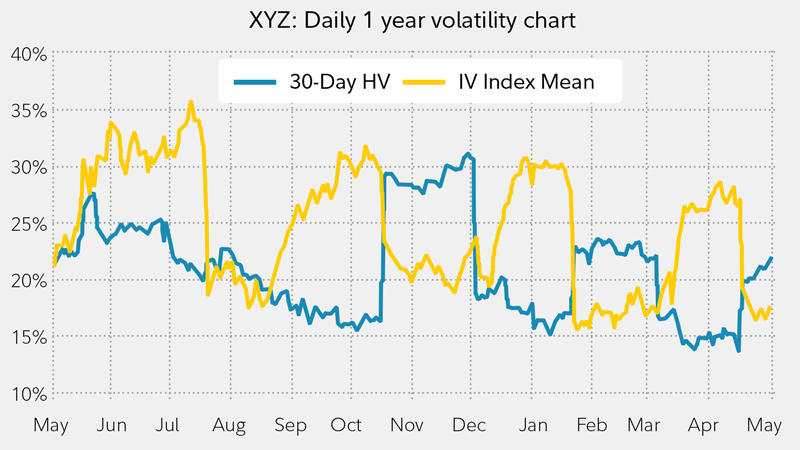

Spy Implied Volatility Chart Spdr S P 500 Etf Trust

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

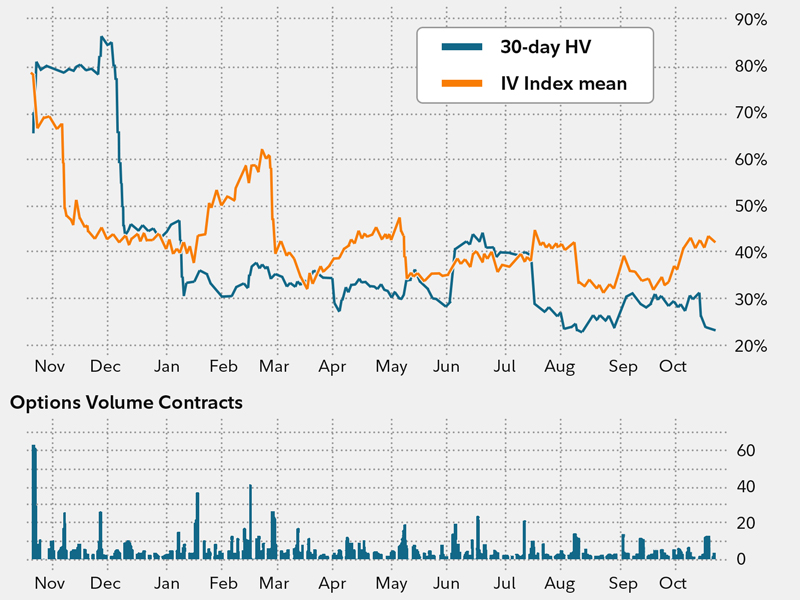

Take Advantage Of Volatility With Options Fidelity

:max_bytes(150000):strip_icc()/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

3 Option Trading Strategies To Profit In A High Volatility Market Guestpost

:max_bytes(150000):strip_icc()/dotdash_Final_Use_Options_Data_To_Predict_Stock_Market_Direction_Dec_2020-01-aea8faafd6b3449f93a61f05c9910314.jpg)

Use Options Data To Predict Stock Market Direction

What Is Volatility Definition Causes Significance In The Market

Calendar Spread Options Strategy Fidelity

Take Advantage Of Volatility With Options Fidelity

Spy Implied Volatility Chart Spdr S P 500 Etf Trust

Pokemon Go Appraisal And Cp Meaning Explained How To Get The Highest Iv And Cp Values And Create The Most Powerful Team Eurogamer Net

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

:max_bytes(150000):strip_icc()/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)